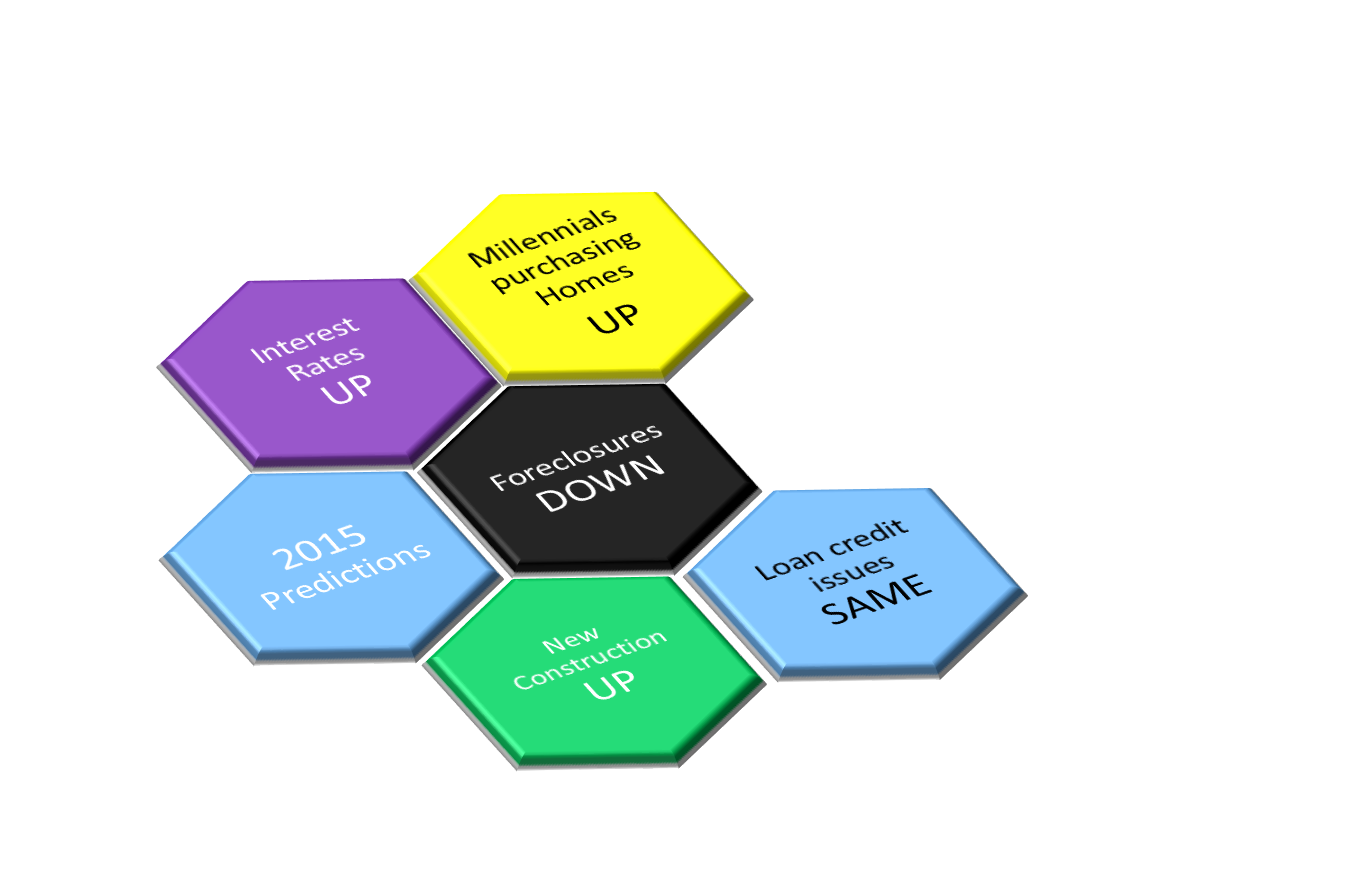

If you’ve been ‘on the fence’ about selling or purchasing a home – make 2015 the year that you take the leap! Here’s a great reason to go for it – In one of my previous posts it indicated that one of the 5 market predictions for 2015 [http://www.realtor.com/news/5-housing-market-predictions-2015/] is that home loan interest rates will go up. The Fed has been threatening to do this for awhile and hasn’t happened…but what if they finally make good on their intended course…? Based on a 30 year mortgage loan at today’s rate (3.98%) vs. what has been predicted by end of 2015 (5.0%) the difference is pretty significant. Let’s assume a $200K loan (P&I only) – monthly payment difference between 3.98% and 5.00% is: $952/mo. vs. $1073/mo. or $122/mo. The ONLY difference is the interest rate. That doesn’t *seem* too bad – BUT, let’s consider over the life of the loan – the difference is: $342,908 vs. $386,513 or $43,604. Now, that’s not chump change!

I’d love to help you with your real estate journey…call me!